Following the political changes that began in Ukraine in 2013, Russia has commenced a hybrid war, which culminated not only in the violation of Ukraine's territorial integrity but also in the annexation of Crimea as well as the commencement of a long-lasting violent conflict in eastern Ukraine. Following these events both the European Union (the "EU") and the United States (the "US") have introduced restrictive sanctions, targeting both private and public entities, and aiming to limit the functioning of financial, energy and defence industries in Russia.

It is acknowledged that the ultimate aim of the sanctions imposed onto Russia is to stop Russia's aggression against Ukraine and to force the Russian political elite to negotiate a peaceful exit by imposing considerable costs onto the Russian economy. However, although the scope of sanctions has been widened several times since 2014, it is acknowledged that the restrictive measures have not tackled the core elements of the Russian economy – the export of oil and gas.

Undeniably, both the EU and the US sanctions create a number of boundaries for the Russian state-owned companies to operate in the energy market by forming obstacles to access financial and technological support. It is calculated that such measures will cost Russia around $600 billion in the period between 2014-2017 in addition to the 3-4% economic decline. However, most of these costs come from sanctions limiting access to the financial markets.

Generally, Russia receives around 50% of its income from state-owned energy companies, hence, the comprehensiveness of sanctions on these companies may, indeed, ultimately determine the success of the sanctions: if the aim of the measures was to stop aggression by means of imposing costs onto the economy, such companies should be regarded as the primary subject upon which limitations shall be imposed. Nevertheless, the current size of Russian oil and gas exports indicate that sanctions may, in fact, be weaker than initially expected, therefore, not producing the results they were meant to produce.

With consideration, this article will seek to address the question of whether the current form of sanctions imposed onto Russia in general, as well as the sanctions imposed onto the state-owned energy companies, are capable of stopping the war in Ukraine. This will be achieved through the analysis, discussion and comparison of the structure of the US and the EU sanctions and the aims such sanctions are meant to achieve, taking into account the theoretical debates and experiences gained from historical examples where sanctions had been used. In principle, the article will aim to answer the question of what is achieved by means of the current sanctions on the state-owned energy companies and to determine what falls beyond the reach of the current version of the sanctions imposed as well as to propose possible expansion of the latitude of the sanctions.

The article concludes that although the current sanctions have produced some considerable economic damage, they have not been damaging enough to create sufficient political pressure in Russia to accept the demands of the West. Both the EU and the US sanctions have focused more on a symbolic and illustrative basis as crucial elements for successful sanctions, such as restrictions on oil and gas sales' activities, fall out of scope of the current version of the sanctions. With this in mind, Russia is not sufficiently motivated to change its aggressive attitude toward Ukraine. Nevertheless, if the Russian oil and gas companies were tackled properly, the likelihood of success of the sanctions would increase.

Following the Cold War sanctions have become a general policy tool to limit the unappreciated activities of certain states by imposing and enforcing restrictive measures that create limits on trade, travel, diplomatic relationships and communications (Annan, 2000). Indeed, the general concept of sanctions and restrictions has been developing for a number of years: from an early instance where Pericles imposed restrictions on merchants from Magara by means of "Megarian Decree" (Lendering, 2005), to comprehensive sanctions against Iran, Kuwait, Iraq and many other states. Nevertheless, at no time from the end of the Cold War until 2014 have sanctions been imposed upon any of the world's great powers.

The economic sanctions imposed by the EU and the US onto Russia certainly represent an important element of the Russian-Ukrainian war: both the EU and the US expect the sanctions not only to become an effective instrument to pressurise Russia to return the Crimean Peninsula back to Ukraine, to stop the war in Eastern Ukraine and to prevent Russia from using further aggression both in Ukraine and in other neighbouring states but also to send a strong message to the international community and their citizens (Veebel et al., 2015). Nevertheless, it is often claimed that neither the EU nor the US seek to completely cut off Russia from the international economic and political arena as that could lead not only to an economic collapse in Ukraine but also to much greater destabilisation and chaos in Russia, which could ultimately threaten the security of Europe (Shevtsova, 2016).

With these surrounding circumstances, and the strategic aims in mind, both the EU and the US established a set of sanctions and restrictions, which have been modified and supplemented, on quite few occasions throughout the period of 2014-2017. Nevertheless, three years having passed since the application of the initial set of sanctions, it does, indeed, seem, that Russia has felt considerable economic losses that led to substantial economic stagnation. Nevertheless, no measures implemented so far forced Russia to return Crimea to Ukraine or even to stop the war in the East-Ukrainian territories. Hence, it is necessary to both analyse the set of sanctions imposed onto Russia until today and to examine the reasons why such sanctions failed to achieve the results they were set to achieve.

The US sanctions on Russia were initially applied in March 2014 and later supplemented by other sets of sanctions throughout the years (US Executive Orders, 2014). Generally, the sanctions imposed by the US could be divided into two categories: the asset freezing measures supplemented by travel restrictions; and sectoral limitations.

Asset freezing and travel limitations are imposed onto the Russian president, Vladimir Putin's, inner circle and officials, who have been engaged in either creation or implementation of the policies towards Ukraine. Overall, there are 64 people, companies and institutions impacted. However, this list of individuals is not definitive (Karpowicz et al., 2015). It is important to note that these restrictions apply not only to the people, companies and institutions on the list but also to all other entities that, in any way, might mediate or represent any parties who are subject to the sanctions (Karpowicz et al., 2015).

Indeed, freezing of assets is not limited to restrictive access of the assets – companies and individuals who are subject to asset freezing measures are also prohibited from engaging in business transactions with US companies and individuals (Nelson, 2017). Among these companies there is the so called 'personal bank of Putin' – Bank Rossiya; and some Russian state-owned defence corporations, such as Almaz-Antey; and the Volga Group, which is owned by a close ally of President Putin (Myers, 2014).

In terms of the sectoral limitations, the US sanctions on Russia are primarily focused on the financial services, defence, and to some extent, energy industries (Karpowicz et al., 2015). The sanctions are established by means of four Directives issued by the Office of Foreign Assets Control ("OFAC") of the US Department of the Treasury. These sanctions contain a number of targeted prohibitions, which limit certain activities of the entities addressed. For instance, sanctions on the financial sector impose restrictions on the allowable debt – banks cannot hold debt for the people on the Sectoral Sanctions Identification List ("SSI") for longer than 30 days' period, which essentially prevent the sanctioned persons from obtaining financial assistance for their activities (Hansson et al., 2014).

The defence and defence-related sectors have been sanctioned by means of Directive 3, which effectively prohibits all transactions which could involve creation of a longer than 30 days' debt (Hansson et al., 2014). In addition to that, the Bureau of Political Military Affairs' Directorate of Defence Trade Controls ("DDTC") within the US Department of State stopped issuance of the International Traffic in Arms Regulation ("ITAR") licences as well as started revoking the existing licences (Karpowicz et al., 2015). Therefore, direct restrictions have been imposed on the export of defence articles and defence services to Russia.

The energy companies, nonetheless, have a limit of 90 days imposed upon them for all transactions in provision of financing for and other transactions where persons identified on the SSI List under Directive 2 are involved (Hansson et al., 2014). However, most importantly, Directive 4 prohibits "the provision, exportation, or re-exportation directly or indirectly, of goods, services (except for financial services), or technology in support of exploration or production for deep-water, Arctic offshore, or shale projects that have the potential to produce oil in the Russian Federation and extending from its territory" (Directive 4). To support such restrictions, the Bureau of Industry and Security ("BIS") at the US Department of Commerce incorporated sanctions into the Export Administration Regulations ("EAR"), which meant that a new requirement of obtaining licencing was introduced for the exports to Russia where the exporter knows that the exported product "will be used directly or indirectly in exploration for, or production of, oil or gas in Russian deep-water (greater than 500 feet) or Arctic offshore locations or shale formations in Russia, or are unable to determine whether the item will be used in such projects" (Hansson et al., 2014). Similar, licencing requirements have also been introduced by BIS for exported products, which could be used for military purposes in Russia (Karpowicz et al., 2015).

The EU sanctions on Russia have been ever evolving – the list of persons and companies affected is consistently expanding and the sectoral range of sanction is rapidly being enlarged (Karpowicz et al., 2015). The EU imposes restrictions both on the individuals belonging to the circle of close President Putin's allies (both persons and companies) and the areas of EU-Russia co-operation (Hansson et al., 2014). Nevertheless, the EU sanctions can also be divided into several types: 1. Travel restrictions – visa bans and asset freezing; 2. Limitations on access to the capital markets for defence and financial services sectors; 3. Constrains on the export of dual-use goods and technologies; 4. Restrictions on oil industry (Hansson et al., 2014).

In March, 2014 the first set of sanctions concerning asset freezes and travel restrictions was introduced. The primary targets of these sanctions were Russian and Ukrainian officials involved in violations of human rights, corruption in Ukraine and annexation of Crimea (Veebel, 2015; Regulation 269/2014). The list currently includes people such as deputy prime minister Dmitry Rogozin, parliament speaker Sergey Naryshkin, Chechen leader Ramzan Kadyrov, one of the closest president Putin's allies Arkady Rotenberg (Russell, 2016).

In terms of access to the capital markets, the EU has created limitations on the financial transactions with certain entities operating in the Russian financial and defence sectors (Regulation 269/2014). However, it must be noted that the EU sanctions imposed on the Russian entities do not create absolute prohibition. Therefore, the EU companies and individuals are still able to trade with the Russian entities in question (Veebel, 2015). Nevertheless, one of the conditions created by EU sanctions was the 90 days' limitation for lending money to five major Russian state-owned banks, three oil companies and three arms manufacturers (Russell, 2016).

In addition to that, transactions involving transferable securities and various financial instruments have also been affected (Regulation 269/2014). These include shares in companies, bonds, depository receipts, treasury bills and various commercial papers. The restrictions involving the above financial instruments have been tightened throughout the months and currently prohibits any dealings with such instruments with a maturity of more than 30 days (Karpowicz et al., 2015).

The dual-use goods and technologies have been affected as well. Currently, restrictions are imposed onto the exports of dual-use goods and technologies if such items purchase with the intent to be used for military purposes, within any reasonable doubt (Regulation 883/2014). In certain instances, the restrictions can be waived by the relevant authorities (Regulation 883/2014). These restrictions, as well as restrictions covering financial assistance and brokering for such goods, have also been extended to some specific entities that the Council listed (Regulation 883/2014). The Council has also formed a Common Military List, which includes military companies and persons, who are prohibited from receiving any technical or financial assistance.

As it will be seen below, what should be the most damaging restrictions, covering the oil industry, are formed in a two-level approach: the first set of sanctions address the sale and export of various technologies used to explore and produce deep water oil, Arctic oil and shale oil in Russia (Hansson et al., 2014). These limitations also apply to brokering, financing and to the provision of technical assistance to the parties, which may be associated with the activities described above. Indeed, similarly, as in the US, authorisation could be sought, however, the authorities will dismiss any request where it is reasonably believed that the technology could be used in a way to extract types of oil identified on the US authorities' list (Hansson et al., 2014).

The second level of sanctions prohibit the provision of drilling, well testing, logging and completion services. Additionally, it prohibits supply of floating vessels for projects associated with the activities listed above (Hansson et al., 2014). However, in this case, the sanctions create an absolute prohibition and no authorisation can be sought.

The answer to the questions of whether or not the sanctions have been effective, and whether or not they achieved positive results, depend both on the expectations and the methods used to evaluate quantitative effect in terms of gross domestic product, investments, currency exchange rates, central bank reserves as well as these elements' influence on the political atmosphere. Indeed, the ultimate aim and expectation behind the sanctions both in the EU and in the US is to stop Russia's aggression against Ukraine and to force Russia by means of economic sanctions to negotiate a peaceful exit from war, and potentially return the Crimean Peninsula back to Ukraine (Veebel, 2015). Hence, to evaluate the effect of sanctions, it is necessary to analyse the Russian economic indicators first, and then examine their effect on the policies pursued by the Russian government.

In spite of various favourable positive elements in the global economy, Russia's economy has been facing serious structural difficulties, which have caused decline in its growth. Although it is hard to claim with absolute certainty, sanctions imposed by the EU and the US have exacerbated the decline even further and it is forecasted that the continuance of sanctions will cause stagnation in the Russian economy (Karpowicz et al., 2015).

Undeniably, it is difficult to assess the extent to which the sanctions have impacted the Russian economy as the sanctions hit at the same time when the price of oil dropped internationally. Nevertheless, considering the drop in oil prices and the sanctions, many economists, including those at the International Monetary Fund ('IMF'), argue that such a twin shock was the main driver behind Russia's economic challenges in 2014 and 2015 (Nelson, 2017).

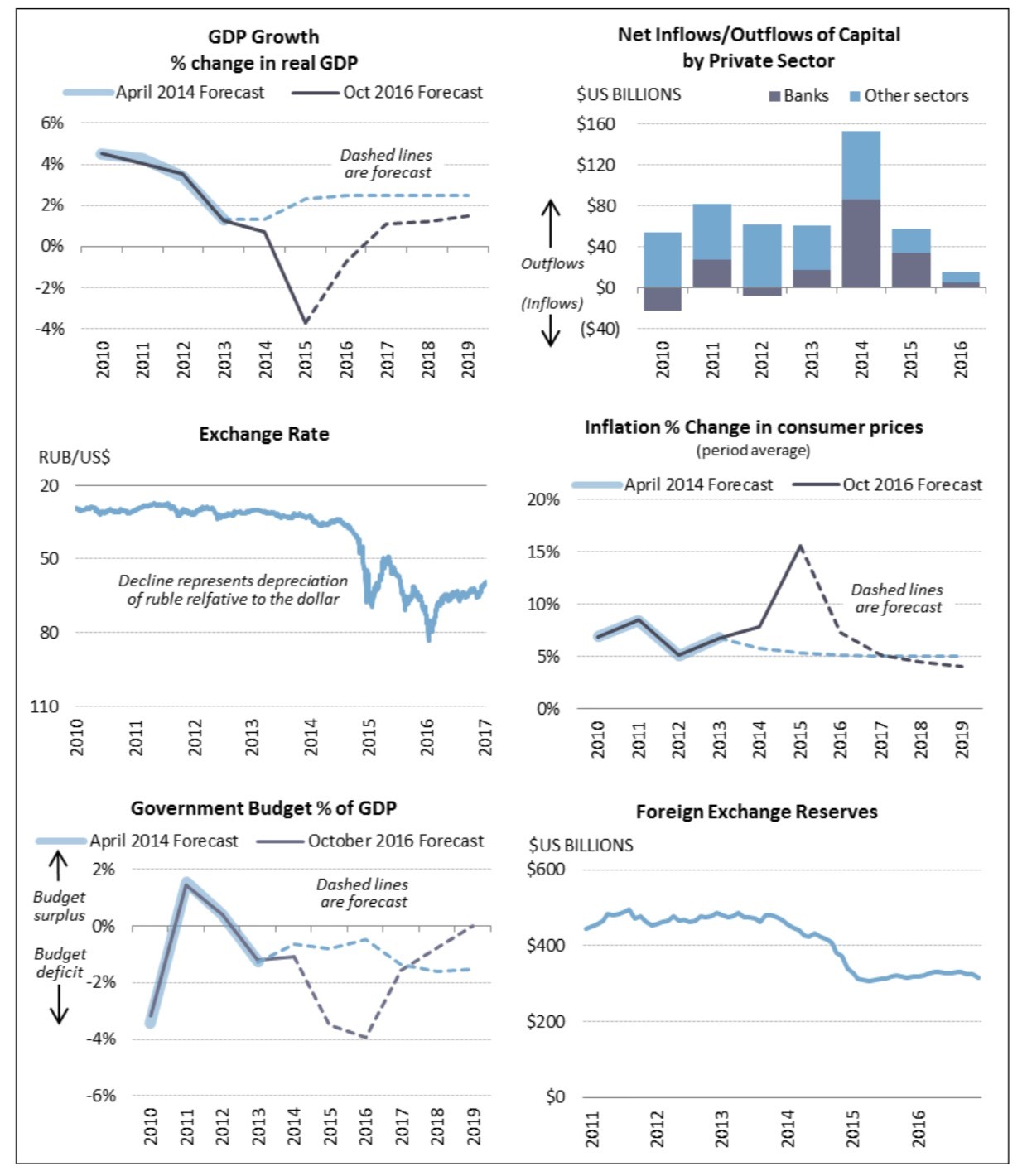

To be precise, in 2014 the Russian economy slowed down by 0.7% and in 2015 Russia experienced a strong contraction of 3.5% (Nelson, 2017; IMF World Economic Outlook). It is also estimated that the Russian economy has faced extensive capital flights, with net private capital outflows totalling $152 billion dollars in 2014, whilst in 2013 it was only $61 million dollars (Nelson, 2017). Rouble, as a currency, in 2015 experienced a strong and relatively rapid depreciation, which amounts to more than 50% compared against the dollar (Nelson, 2017). Inflation, too, went up from 6.8% in 2013 to 15.5% in 2015 (IMF World Economic Outlook). The budget deficit increased from 0.9% in 2013 to 3.2% in 2015 (Nelson, 2017). Russia's reserves felt from $500 billion dollars in 2014 to $368 billion dollars in 2015 (IMF World Economic Outlook).

Indeed, the losses Russia experienced seem considerable. Nevertheless, despite such losses, the primary objective of sanctions has not been achieved. In fact, in 2016 Russia's economy has to a large extent stabilised, although sanctions as such are being maintained and even strengthened in some instances (Rampton et al., 2017). In 2016 Russia's economy had been contracting by a much slower pace of 0.8% (IMF World Economic Outlook). The capital flows in the private sector had been falling and totalled only $15 billion dollars in 2016 (Nelson, 2017). The rubble got stabilised and inflation fell by more than half to 7.2% (Nelson, 2017). However, most importantly, Russia's economy has been enjoying increasing quantity of oil sales as well as increased oil prices from about $30/barrel to over $50/barrel (Global Price of Brent Crude).

The statistical models and analyses prepared by the IMF suggest that in 2015 the EU and the US, sanctions on Russia, combined with Russia's counter-sanctions, reduced output over the short term in Russia by 1.0% to 1.5% (IMF, 2015). The IMF also suggest that over the medium term Russia should experience more substantial reduction in output, which should reach 9% (IMF, 2015). According to the Russian authorities, in 2014 the sanctions were estimated to cost around $40 billion dollars to the Russian economy (Russell, 2016) and it was predicted that 4% to 5% drop in GDP should have been seen (Nelson, 2017).

Despite these results, the effect of sanction upon Russian economy is much less substantial if compared to the effect of low oil prices. In November 2014 it was predicted that the GDP in Russia would contract twice as much as it would due to imposition of sanctions. In monetary terms that should have amounted to around $100 billion dollars (Gurvich et al., 2015). The Russian President himself has noted that, indeed, sanctions 'are severely harming Russia', however, the harm is not as severe as harm caused by the oil prices (Blome et al., 2016).

Figure 1 – Economic Tendencies in Russia

Source: Created by CRS using data from the IMF World Economic Outlook and the Bank of Russia (Nelson, 2017).

In fact, these then predictions were confirmed in 2016 by the US State Department, which had published a report, addressing the impact of the sanctions on a firm-level basis (Ahn et al., 2016). According to the report, Russian companies, consequentially, lost considerable chunk of revenue due to sanctions, however, the report confirms that sanctions had much smaller impact compared to oil prices.

Indeed, the fact that sanctions had a less substantial effect than low oil prices does not mean in itself that the sanctions are ineffective. However, it is transparent that the aims of the imposition of the sanctions have clearly not been achieved. Certainly, the Russian economy has been affected by the sanctions, nevertheless, the war in Ukraine continues.

In fact, when it comes to the sanctions' effect on the Russian foreign policies, as of July 2017, it is unambiguous – irrespective of the sanctions, Russia is continuously supporting the war in Ukraine and even strengthening its presence in Eastern Ukraine day after day (Baer, 2016). In addition to that, Russia is consistently organising massive military exercise – ZAPAD, aiming to practise the attack on the Eastern European countries, next to the NATO border (Gordon et al., 2017). That once again indicates – although sanctions are damaging the Russian economy, the Russian policies towards its neighbouring countries do not change.

It is well known that the set of sanctions imposed by the EU (and to some degree by the US) are based on the notion that they should not cause too much suffering to the EU states (and the US) themselves (Shevtsova, 2016). Neither the current set of sanctions is created to make costs for the Russian economy unbearable. Indeed, the current set of sanctions excuse the core sources of Russia's income from the sanction, which ultimately suggests that Russia is not motivated enough to withdraw itself from the war in Ukraine (Veebel, 2015; Kramer, 2015; Shevtsova, 2016). In fact, the EU openly admits that the gas and oil sectors were exempted from sanctions because a number of the EU states heavily depend upon Russian supplies (Szczepański, 2015).

According to the statistics issued by the World Bank, in 2011, 16% of Russia's GDP comes from revenue associated with natural resources, whereas oil and gas accounts for 13.6% and 2% of GDP respectively (World Bank, 2011). In addition to that, more than half of the federal budget in Russia comes specifically form oil and gas revenues (World Bank, 2016). Oil and gas exports also form 70% of the overall country's exports (Sanhar, 2015). At the moment, Russia is the leading large producer of oil and the second largest producer of gas in the world, which further indicates Russia's strong dependence not only on the international prices of commodities but also their export potential to other countries (Carpenter, 2017).

The energy sector in Russia is considered to be highly strategic and often the production and supply of energy is limited to privately owned domestic and national (state-owned) companies only (Sanhar, 2015). Nevertheless, privately produced oil, by companies such as Russneft, Surgutneftegaz and Lukoil, on average, represent only one third of total oil production (Sanhar, 2015). The largest part of oil and gas production is managed by the state-owned companies such as Rosneft, Gazprom, Neft, etc. In terms of the exportation, around 90% of oil pipeline network is controlled by Transneft, which is also a Russian state-owned monopoly (Sanhar, 2015).

Neither gas nor oil, nor the export of gas and oil sectors are diversified and open to the mechanisms of free market in Russia. These sectors are highly monopolised and, as above statistics indicate, government is vastly dependent upon the revenue generated by these sectors. Indeed, government's dependency can also be illustrated further by considering the overall diversification of Russia's exports: according to the US Energy Information Administration, in 2013, 33% of Russia's overall exports came from oil, 14% from gas, 21% of petroleum products and only 32% of the whole country's exports came from exports unrelated to oil and gas sectors (US Energy Information Administration, 2013).

Strong dependency upon a highly limited number of sectors – in this case, oil and gas sectors – implies that any changes or negative externalities may have a damaging effect on the whole country. In other words, since the revenues of federal budget are highly dependent upon these sectors, any negative impact to these sectors could easily result in reduced welfare spending, lower subsidies to healthcare, education and military, and it could affect the overall standard of living of Russian citizens throughout the country. Thus, all decisions and policies related to both internal and external policies of Russia are highly dependent upon how successful Russia's gas and energy sector is.

The strength of the Russian currency, the rouble, is also highly dependent upon the performance of oil and gas sectors in Russia (Henderson et al., 2017). Since oil and gas production forms the largest part of the federal budget in Russia, the decrease in oil and gas prices or the decrease in the overall exports of commodities force the rouble to fall (Henderson et al., 2017). In other words, when revenue coming into the budget decrease, in order for the Russian Central Bank to cover the losses, the Bank is obliged to devaluate the Rouble to cover the losses (Sanhar, 2015). Hence, when oil and gas sector is affected, not only the budget and various subsidies decrease but also the savings and the income of the citizens of Russia decrease and the prices of the products imported from abroad increase, too.

Indeed, the political outcomes, in the case of decreasing oil and gas production may be crucial, too. Dropping subsidies and lower standards of living may lead to changes in the government, as well as potentially causing the public to protest against the unnecessary costly activities, such as, military activities (Ortiz et al., 2013). In addition to that, decreasing standards of living are likely to lead to public support for a change to the foreign policy, potentially leading to the increased welfare of the society (Ortiz et al., 2013).

All of the above indicate that Russia's dependency upon oil and gas is evident. Hence, were the exports of Russian commodities interrupted, Russia would suffer both politically and economically.

As noted above, some of the sanctions imposed onto Russia apply to the gas and oil sectors. These sanctions primarily limit access to modern technology and foreign loans and impose restrictions on the exploration of deep-sea and Arctic oil deposits (Mäe, 2016).

Evidently, Russian oil and gas companies are highly dependent upon foreign technology. It is estimated that Russian oil companies have to import around 50% of equipment and 80% of software used for heavy oil production from the Bazhenov formation (Novak, 2015). It is also estimated that these companies need to import 80% of equipment and 90% of software to exploit deep-water deposits (Novak, 2015). In addition to that, since sanctions on technology extend to the 'spare parts' imported from abroad, certain platforms used to explore oil are strongly affected – for instance, the drilling platform used by Gazprom Neft in the Prirazlomnoye deposit is 90% dependent on these parts (Mäe, 2016).

Overall, the sanctions upon technology affect around 68% of overall imported equipment. In turn this forces companies such as Rosneft to postpone, or to even cancel the planned explorations in the Russian Arctic (Mäe, 2016). Companies, such as Gazprom Neft and Surgutneftgaz, are also unable to use their onshore deposits such as Bazhenov formation as horizontal drilling and multi-stage shale fractioning requires the technologies affected by the sanctions (Mäe, 2016). Similar issues are faced with by the companies exploring deposits in the Pechora Sea and in the coast of the Yamal Peninsula (Mäe, 2016). Due to the sanctions, Gazprom's planned expansion of a gas liquefaction factory in Sakhalin had to be postponed, too (Bierman, 2015).

In terms of restrictions on foreign loans, companies such as Gazprom Neft, Rosneft, Novatek, Transneft no longer have access to financial products and loans from the West, which creates certain difficulties for these companies to finance their endeavours (Mäe, 2016). At the same time these companies are unable to develop new projects requirement major investments such as, for instance, in the Arctic or in deep geological formations (Sokolov, 2015). As a result, for instance, Rosneft, when compared to 2014, cut its investments by 30% in the following year (Mäe, 2016).

Nevertheless, although the restrictions create certain difficulties for the oil and gas companies, so far sanctions have not led any of these companies to serious difficulties. In fact, when it comes to technologies, quite a lot of equipment as well as spare parts can now come from China and South Korea (Mäe, 2016). Thus, although not all technologies can be accessed, alternatives to them are created. In addition to that, Russian government published an 'import substitution plan' (Mäe, 2016), whose effectiveness is limited so far, however, plans of overcoming the sanctions are, indeed, created.

As far as financial assistance is concerned, the Russian Welfare Fund does, indeed, offer assistance. By March 2016, there were two companies – Rosneft and Novatek – which already asked for financial assistance (Mäe, 2016). Novatek has also sold 10% of Yamal LNG to China's Silk Road Fund, which should help obtaining loans from the Chinese banks (Reuters, 2016). Indian investors have also agreed to invest into Rosneft – ONGC received additional 11% stake in Vankorneft (Prasad, 2016).

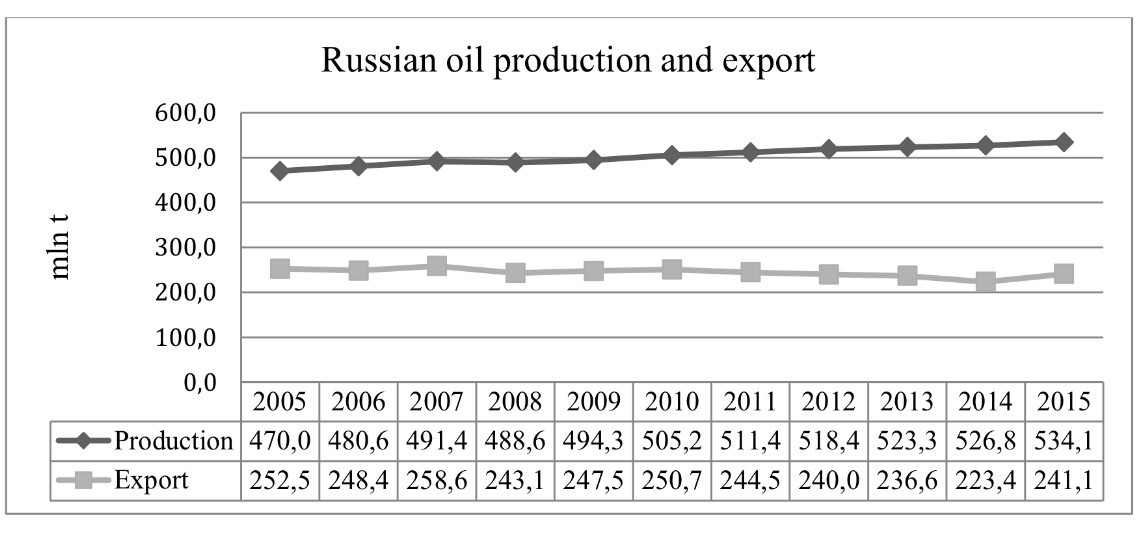

Also, sanctions have no effect on the oil and gas production coming from existing oil and gas deposits and only covers new deposits (Mäe, 2016). As a consequence, Russian oil and gas companies concentrate on the exploration of the existing deposits, which led to increasing production as well as increasing exports (Interfax, 2016). Overall, in 2015 Russia produced 534 million tons of oil, which is 1.4% more than in 2014, and exported 241 million tons, which is more than 10% more than in 2014 (Mäe, 2016). In 2016 the total oil export from Russia reached 253 million tons, which is 5% more than in 2015 (Astakhova, 2016). In 2017 the number are forecasted to continue going up further (Mäe, 2016).

Figure 2 – Russian oil productions and export

Source: ЦДУ ТЭК, ФТС (Mäe, 2016)

It is not only that the overall exports that are growing, but also the exports of some oil products to the EU are growing, too. If, for instance, exports of refined petroleum were considered, it would be seen that the exports grew by 3% in 2015 (compared to 2014) (OEC).

The exports of oil and gas related products are increasing as well. For instance, Gazprom in 2016 Gazprom delivered 179.3 million cubic meters of gas to Europe, which is 12.5% more than in 2015 (Gazprom, 2017). Gazprom has also increased its share in the European gas market to 34%, which is the highest market share Gazprom has ever held in Europe (Foy, 2017). It is also forecasted by Royal Dutch Shell and BP that Russia will remain the biggest supplier of gas to Europe at least until 2035 (BP, 2017).

In fact, it must be stated that since the current sanctions do not apply to the subsidiary entities of the Western companies in Russia, Russian companies are overcoming the restrictions by acquiring the assets of the Western companies in Russia (Mäe, 2016). For instance, Schlubemberger and Baker Hughes continue working with Gazprom Neft in Pechora Sea, and Halliburton continues working with Gazprom Neft and Lukoil (Mäe, 2016). In fact, some Western companies that have close links with Russia declares possible expansion plans in Russia: for instance, BP together with Rosneft have recently declared seeking to bring more Russian gas to Europe (Ambrose, 2017).

All of the above suggest that although the Russian oil and gas sector is affected by the sanctions and although it is forced to suffer damages as well as to reorganise and restructure the way it functions, sanctions do not create any unmanageable measures that companies could not work around. The oil and gas companies are able to handle technological aspect by means of diversification among the countries supplying technologies and spare parts. Production and exports, too, are not only increasing in general but to a degree exports to the EU are increasing as well. Thus, when it comes to oil and gas sector, the effect of sanctions in highly limited.

The historical record of sanctions contains more than 125 instances where sanctions have been used in the period between 1914 and 1996 (Rogers, 1996). Generally, it is claimed that sanctions more often are unsuccessful than successful (Rogers, 1996), however, in those instances where sanctions have created great economic damage, success has been achieved more often (Veebel et al., 2015). Therefore, it is important to examine the historical events where sanctions have been used to achieve political results, namely where sanctions have been used to change the targeted country's policies.

Similarly, just as Russia has, Iraq has been growing its dependency upon oil throughout the years (Alnasrawi, 2001). Although in the early 1960s Iraq's income from oil surmounted only to $266 million dollars, the extraordinary developments, including nationalisation of the oil sector and rising exports, in the 1970s pushed the state's oil revenue to $26.1 billion dollars in 1980 (Alnasrawi, 2001). In other words, Iraq increased its dependency upon oil from 3% in 1950 to 56% in 1980 (Alnasrawi, 2001). Throughout the period indicated above, Iraq's economy was growing drastically and most of the social indicators were on the rise, too. Consequently, the state became highly dependent upon its oil industry.

Indeed, when sanctions against Iraq have been imposed for the invasion of Kuwait, Iraq was already suffering due to the war with Iran. Nevertheless, at the time, Iraq was still receiving most of its income from the oil sector. The centrepiece of the sanctions against Iraq was United Nations Security Council Resolution 66. Effectively, this Resolution together with subsequent resolutions cut Iraq's access to the international markets. The sanction among other implications not only limited Iraq's ability to import products and services but also established an oil embargo (Alnasrawi, 2001).

In fact, sanctions had such a strong economic effect that 97% of its exports had been cut (Habib, 2015). That consequently created serious disruptions to the economy. Indeed, sanctions had strong negative effect for the people of Iraq, too: between the time sanctions were imposed in 1990 and the time when Iraq was allowed to export its oil abroad in 1990, unemployment and emigration grew drastically; poverty spread among the people and a lot of schools were closed (Alnasrawi, 2001). Nevertheless, such great economic damage had some strong positive effects.

First of all, strong economic pain has slowed Iraq's ability to rebuild its military – the state neither had access to spare parts to fix aging military equipment, nor did it have enough funds to purchase such parts (Marr, 1995). In addition to that, the sanctions were strong enough to compel Iraq not acquire weapons of mass destruction (Rogers, 1996). Sanctions have also contributed to Iraq's decision to recognise Kuwait as a state (Rogers, 1996). Sanctions have also made Iraq starting negotiations with the UN (Meisler, 1996); and, indeed, the multitude of the sanctions imposed sent a great message not only to Iraq but also to the other potential aggressors that the West is capable of injuring aggressor's economy and making it unbearable for the country to survive.

On the other hand, it is argued by some that sanctions have actually failed in Iraq. This opinion is founded on the basis that dictator Saddam Hussein remained in power and that Iraq did not withdraw its troops from Kuwait in 1990-1991. Nevertheless, it is important to note that, in fact, at the time Saddam could neither have been overthrown by means of sanctions nor that it could have been achieved, as events have shown, by military force (Rogers, 1996); and as far as military troops in Kuwait were concerned, sanctions have not been left in place long enough to accomplish the task – President Bush decided to proceed with a military action six months following the crisis (Rogers, 1996).

Indeed, the failure of sanctions to overthrow Saddam could suggest that sanctions have been successful only to a degree. However, that notion shall not obscure the success they have achieved (Rogers, 1996). In fact, assessing these sanctions through the prism of options available at the time evidences that these sanctions were effective and successful.

Currently, Iran has an estimated 157.8 billion barrels of oil, which amount to around 10% of the world's total oil reserves (BP, 2016). Iran is also ranked third for the oil reserves in the world. Also, Iran is the fourth largest exporter of crude oil, and produces more than 4.5 million barrels of oil per day (US Energy Information Administration, 2017). Iran also has massive gas reserves that are estimated to be more than 29,619 billion cubic meters – that makes Iran second in the world for its gas reserves after Russia (BP, 2016). Nevertheless, Iran's gas production is relatively limited due to lack of infrastructure, hence, Iran only produces around 120 billion cubic meter a year (LNG, 2012).

Not surprisingly Iran's economy is highly dependent upon these resources. It is calculated that in 2010 80% of Iran's foreign currency revenue came from oil exports, and that formed 60% of the overall country's budget (Telegraph, 2012). Not surprisingly, Iran uses the income derived from oil and gas to fund its activities both at home and abroad.

Iran has been subject to sanctions for decades since the Iranian Revolution in 1979 for its uranium enrichment program, however, sanctions concerning its energy sector have only been introduced in 1996 by the US and 2012 by the EU (Samore, 2015). It is calculated that sanctions have contributed to the termination of $50 to $60 billion dollars in upstream energy investments, 90% drop in gasoline sales and suspension of multi-billion dollars' projects (Goodspeed, 2012). In other words, sanctions, indeed, caused serious economic damage to the country.

As a result of sanctions, in 2015 Iran agreed to destroy its stockpile of medium-enriched uranium, reduce its reserves of low-enriched uranium by 98% and reduce by two-thirds the number of its gas centrifuges for 13 years used for the enrichment of uranium (Sanhar, 2015). That, once again, suggest that once economic damage is considerable, the state will comply.

Although Syria is a relatively minor oil producer in comparison to other Middle East producers – Syria's production of oil amounted to 0.5% of the global production in 2010, domestically, oil sector is fundamental. It is calculated that in 2010 around 25% of the state's overall revenue came from oil (IMF, 2010). Importantly, Syria's biggest oil market is the European Union. Syria produces around 385,000 barrels of oil per day, of which around half is exported to the EU countries, namely, the Netherlands, Italy, France and Spain (Hutton et al., 2011).

In September, 2011 it was decided by the EU to extend the initial sanction imposed upon Syria to include importation, purchase and transportation of oil and petroleum products that originate in, or have been exported from, Syria (Hutton et al., 2011). Such sanctions had a prompt effect: in 2011 Syria received more than $3 billion dollars from the exports of crude oil into the EU, whilst in 2012 there was no crude oil exported into the EU. Since 2012 vast majority of Syria's crude oil goes to the Indian market and amounts only to $50-100 million dollars (Hutton et al., 2011).

Indeed, Syria's losses are considerable. However, quite opposite from the earlier examples, the effect from the sanctions are relatively ambiguous: on one hand, given the volumes of Syrian oil historically imported from Syria, losses of income are, indeed, substantial, however, on the other hand, these losses neither ended the war, nor did they have strong effect on regime changes.

Certainly, it is likely that great losses in state income will cause policy changes as in Iraq or Iran provided that sanctions are kept in place for a sufficient period of time. Nevertheless, it is generally believed that sanctions are more likely to bring about positive results when applied to countries engaged in interstate wars rather than in civil conflicts (Rogers, 1996). This is due to the reason that in civil wars, it is not only the states that are parties to the conflict. Hence, imposing state only restrictions not likely to be enough for ending the conflict. Nevertheless, in Syria's case, since the number of parties involved is considerable, limiting state's activities by means of sanctions and fighting the other parties by means of military may, indeed, produce some positive results.

In fact, it is suggested that not only economic difficulties, such as collapse of industrial activities and lack of investments, are present but also the government of Syria is no longer able finance its military activities as it used to (Bender, 2015). Indeed, Syrian government does receive military assistance from its allies, however, its own military is highly affected due to sanctions (Rahman-Jones, 2017).

Indeed, there is a number of variables behind achieving success by means of sanctions. Nevertheless, the above examples indicate a strong negative penalty, causing substantial economic losses, and ultimately motivating the targeted countries to change their policies. Certainly, the success does not occur rapidly: sanctions must be maintained for as long as the targeted country starts experiencing the economic consequences.

The effectiveness of the sanctions described may, indeed, be confronted as in some instances sanctions upon oil and gas companies were not the only sanctions imposed at the time – in some instances, various other sanctions had been established, in addition to the military action that had been taken. Nevertheless, sanctions described above do tackle the most considerable sources of state income; and without such income the targeted states can neither confront military nor they can resist other types of sanctions, and, therefore, agree to comply.

As noted above, Russia is highly dependent upon its oil and gas foreign sales. However, although Russian economy is affected by the sanctions, the effect of such sanctions is far from considerable: Russia is able to fight back the technological aspect of sanctions by means of diversification; financial aspect by means of getting resources from China and India; and when it comes to exports, oil and gas revenue coming from the EU is continuously increasing, hence, Russia is currently neither motivated nor pressurised to change its policies in Ukraine.

In order to achieve success, or at least partial success in Ukraine, Russia must be pressurised and dragged into position where its links are cut if no changes in policy occur. In other words, Russia needs to receive an open message requiring the country to cease its military activities in Ukraine by means of creating measures considerably cutting Russia's income. That could, indeed, be achieved by means of strengthening current sanctions to tackle companies generating Russia's primary income, namely oil and gas companies. Indeed, such measures would cause some great damage to the EU and, to a certain degree, to the US, however, any changes in Russia's policies in Ukraine can occur only if Russia faced some considerable economic damage.

From Russia's point of view, its dependency on the exports to the EU is too great to be lost. It is well known that Russia often takes actions based on cost-benefit analyses, hence, rationality is likely to prevail in case the damages are too great to recoup (Dashti-Gibson et al., 1997). In addition, it unlikely Russia would be able to diversify its exports to the degree where losses are manageable as currently the EU is its primary export destination.

To be precise, in order to achieve sufficient pressure, both the EU and the US actions, first of all, would need to extend the current sanctions to include companies working and contracts associated with the existing oil deposits. The current set of sanctions does not preclude companies from investing in and growing its revenue from the oil deposits, which started to be explored prior the imposition of the sanctions. International loans, financing and access to technologies must also be cut off for the exploration of existing oil deposits.

Secondly, although it would be costly from the EU's point of view, the level of Russian gas and oil being imported to the EU would need to be limited. Cutting oil and gas imports may not be possible to achieve in its entirety, however, reducing the amount of imports throughout the years is, indeed, a viable option. However, in order to do so, projects such as, for instance, Nord Stream-2 need to be stopped.

In fact, at the time this article is being drafted, the US is passing a new set of sanctions potentially capable of having considerable effect on the Russian economy through the Senate. If approved, the new sanctions will hit Gazprom hard, which is the main driver of the Nord Stream 2 project. That means Russia will not only lose its investments up to date, but it will experience great losses in its future gas revenue. Nevertheless, since a number of EU based companies, namely, Engie, Shell, OMW Group, Uniper and Wintershall, are participating in the project, the EU's leadership does not seem to be in support of the new sanctions, although, such sanctions could finally deliver some positive results.

It is acknowledged that, indeed, the new US sanctions could potentially hurt the competitiveness of US companies and they could even hamper oil and gas production in many other countries than Russia (Crooks, 2017), nevertheless, only strong and consistent sanctions could deliver. In fact, countries such as Poland, Lithuania, Latvia and Estonia are ready to take the hit and accept potential costs to the economy (Beesley et al., 2017), nevertheless, if the aim is to punish Russia and end up war in Ukraine, the EU's leadership needs to accept the US sanctions and to implement similar ones, too.

Nevertheless, Nord Stream 2 is not the only matter that needs to be stopped. It is evident that both Russian and European companies are finding ways to disregard the limitation created by the sanctions: for example, in 2015 Gazprom, E.ON, Shell an OMV Group signed a memorandum of intent stipulating the cooperation among the companies in building infrastructure for Russian gas to reach European consumers (Gazprom, 2015). Some Western companies found ways to even work in Crimea (Mäe, 2016). Unless sanctions strengthened to tackle these scenarios, sanctions are meant to fail.

Indeed, it is suggested that the current sanctions have, in fact, been partially successful as, firstly, the war in Ukraine did not go beyond Eastern side of the country; and, secondly, Russia did not initiate any military actions in the other countries, such as the Baltics. Nevertheless, that should not be taken as a benchmark as it could be argued the opposite way: since the current sanctions are weak and not creating sufficient economic losses for Russia, the Russian government can, in fact, elaborate the conflict in Ukraine as well as to engage into some new conflicts. At the same time, the Russian public, instead of experiencing economic difficulties, may, in fact, 'rally around the flag' and support the Russian government for its new plans and actions.

Therefore, in order to achieve success – end the war in Ukraine – stronger and more efficient sanctions are needed; and that could only be achieved if the Russian oil and gas companies are sufficiently targeted.

This approach is also supported by empirical evidence presented in this article. The historical examples demonstrate that where sanctions are comprehensive and where they do limit states' primary income, success is more likely to occur. Certainly, the examples presented herein are limited in its nature and further research is needed in order to ascertain whether sanctions on the primary states' income are the most effective means of sanctions to achieve the desired results. Nevertheless, sanctions strongly limiting states' income are more likely to bring about the results expected.

Following Russia's aggression against Ukraine, both the EU and the US imposed a number of restrictions onto Russia. These boundaries aimed to limit functioning of financial, energy and defence industries in Russia. Namely, the sanctions meant that certain assets of the political leaders will be frozen, travel restrictions will be imposed and sectoral limitations, restricting Russian companies' access to foreign loans as well as to the technological assistance, would be created.

Indeed, such sanctions due to their comprehensive latitude achieved some results: the Russian economy slowed down and later contracted considerably; economy faced extensive capital flights; the rouble experienced a strong and relatively rapid depreciation; inflation rose; and the budget deficit increased 0.9% in 2013 to 3.2% in 2015. Nevertheless, in spite of the economic difficulties, the aims of the sanctions have clearly not been achieved as the war in Ukraine continues.

The core reason why the current sanctions do not achieve the results they were meant to achieve is due to the fact that the current set of sanctions do not make costs for the Russian economy unmanageable. In fact, the current set of sanctions do not apply to the core source of Russia's state income – oil and gas sector - which ultimately suggests that Russia is not motivated enough to withdraw itself from the war in Ukraine.

More than half of the federal budget in Russia comes specifically form oil and gas revenues. Oil and gas exports also form 70% of the overall country's exports. Nevertheless, apart from the access to foreign loans and foreign technologies, the Russian oil and gas sector is not affected. In fact, quite the opposite is seen: Russia's oil production, and its exports have been rising consistently year after year. What is so important to consider, is that not only the overall exports have grown, but also the export of some oil products to the EU have consistently grown, too. All of that suggests that although Russian oil and gas sector is affected by the sanctions, sanctions do not create any unbearable measures that companies operating in this sector and Russia in general could not handle.

The empirical evidence and the historical examples of sanctions imposed onto Iraq, Iran, Syria indicate that although, there are a number of variables behind achieving success, creating strong negative conditionality and causing substantial economic losses do motivate the targeted countries to change their policies. Certainly, success does not occur rapidly and often success is only partially achieved, nevertheless, where sanctions tackle the most considerable sources of state income and create an unmanageable burden for the country's economy, success is more likely to occur.

Therefore, in order to achieve success and in order to motivate Russia to withdraw itself from the war in Ukraine, the current sanctions would need to be extended to include companies working and contracts associated with the existing oil deposits; international loans, financing and access to technologies should be cut off for the exploration of existing oil deposits; and, importantly, projects such as Nord Stream-2 must be stopped. However, with the current political climate surrounding worldwide politics, this is highly unlikely. Nevertheless, as the empirical evidence presented herein suggest, unless stronger and more efficient sanctions are imposed onto Russia and unless the Russian oil and gas companies are sufficiently targeted, the war in Ukraine is unlikely to end.